23 Sep 2022

Biggest tax cuts announced since 1972 and it wasn’t even a Budget!

Biggest tax cuts announced since 1972 and it wasn’t even a Budget!

Liz Truss and Kwasi Kwarteng have firmly set out their stool as being pro-growth. In a wealth of tax cuts announced today, we see their clear intention to

stimulate the economy with these cuts.

They have abolished the higher rate of tax of 45% on income earned above £150,000, leaving the highest rate of tax at 40% on income above £50,270. In addition, a

cut in the basic rate of tax from 20% to 19%, both of which will be in effect from the next tax year, 6th April 2023.

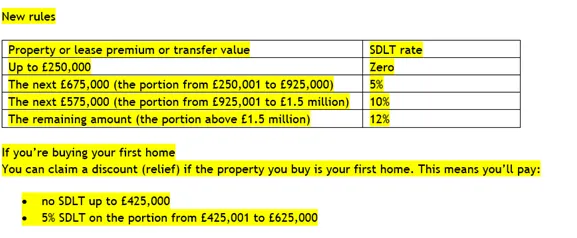

Clearly, the biggest impact to our industry is the change in Stamp Duty rules which change immediately.

Kwasi’s new rules will see 200,000 buyers move out of having to pay any stamp duty at all, and saving every second time buyer purchasing above £250,000 a sum of

£2,500.

The New Rules

Nil rate band of stamp duty raised from £125,000 to £250,000, saving £2,500 for buyers buying above £250,000.

For First time buyers a new tax free band up to £425,000 and the limit for claiming this relief has also raised from £500,000 to £625,000.

Therefore, a first time buyer completing yesterday at £550,000 would have paid £17,500, where as from today onwards will only pay £6,250, a saving of £11,250.

Any cut in Stamp Duty is a positive for me, especially reducing the costs for first time buyers which is essential for a functioning housing market.

The fact that this is a permanent raise of thresholds and not a just a ‘holiday’ is welcomed, as we saw huge disruption post pandemic with lenders and solicitors struggling to cope with these deadlines, and this exacerbated house prices out of reach of many first-time buyers.

Raising of these limits is long overdue, and it isimportant to add will also benefit landlords and second home buyers.

With any purchases above £250,000, landlords will also benefit from the saving in stamp duty, although at present the additional 3% for purchasing second home will still apply.